Another Brexit post. Yawn.

This isn’t a political broadcast, this is a short insight into problems and opportunities faced by the British furniture industry, brought on by volatility in the pound. Of course many of these problems are replicated in other industries such as consumer electronics or cars, but as I’m an expert in neither of those, I’ll leave that to PC World and Top Gear.

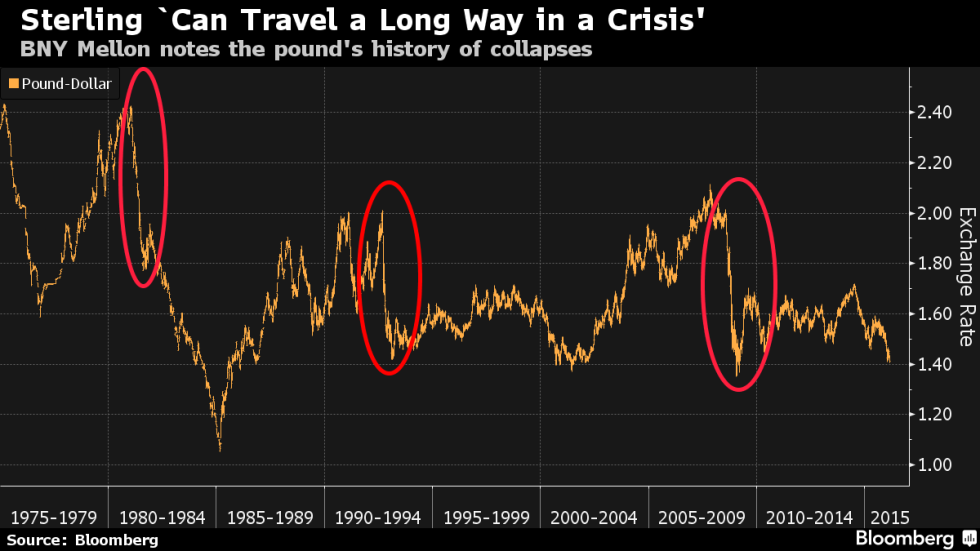

The headlines across financial markets have been “Sterling Drops to 31 Year low” which conjures up images of irritated Brits spluttering ‘how much?’ at the beach bar on holiday whilst UK exporters rub their hands together as their market takes off. There is very much a flip side of positives and negatives here, littered with dangerous potholes.

As we know Britain has a trade deficit: net import is higher than net export. In terms of furniture, there is a complex network of furniture importers, dealers and distributors across the UK that act as trusted local agents for their clients. These businesses collectively bring in huge quantities of furniture and interior goods to the UK. The big danger to these companies is short to medium term volatility. Here’s the scene:

- Week 1: Regional dealer wins sought after project at competitive margin.

- Week 2: Quotation agreed with local client in Pound Sterling.

- Week 3: Orders placed with European supply chain, buy prices in Euros. (rate 1.2)

- Weeks 3-9: Market volatility follows, pound drops sharply.

- Week 9: Furniture arrives along with supplier invoice (30 days).

- Weeks 9-12: Pound Sterling continues to drop and hits 1.1.

- Week 13: Unlucky for some. Supplier invoice due…

That’s a big hit to anyone’s margin and can easily render a project loss-making. For a five or six figure furniture contract, that’s potentially a huge loss to the bottom line.

“Many agents and overseas manufacturers are now feeling the pain of subsidising the weak Pound…”

Aside from regional dealers there are national agents who try to steady the ship by setting a rate for the year ahead. There will be many agents and overseas manufacturers now feeling the pain of subsidising the weak Pound after betting against the possibility of Brexit last year. January is the time many new 2017 price lists drop and the UK market can expect significant cost increases from American, European (and other currency) suppliers.

Meanwhile UK exporters are hugely optimistic (unless they are heavily reliant on foreign components purchased in other currencies that is) and have to take advantage of overseas opportunities. But whilst there are always short term advantages in these volatile markets, any long term successful strategy needs to be just that – long term. It’s easy to bag some quick overseas wins when your currency is bargain basement, but if and when it returns you might need to do the subsidising if you want to keep developing that new business.

Managing Risk and Exposure

So what can and what does the British industry do to repel the volatility of the Pound? Of course many importers agree a long term exchange rate in advance. The local dealer / agent would be wise to buy foreign currency in advance through a reputable currency trader (rather than a dodgy bloke in a mac at the local bus interchange…..?). Open a Euro account with your bank and spread the pain whilst exchanging chunks at better rates, in advance of that big project coming in. As risk and financial advisors will always say – it’s about managing your company’s risk and exposure.

But is the UK Government doing enough to support the importers? New PM Theresa May is certainly taking decisive action and Brexiteers are keen to point at the export market as a response to the weak pound, but for importers who have built successful businesses on importing quality goods, volatility means sleepless nights. Is there something else that can be done to support this important sector of the industry? Could there be a relief tax for importers who can demonstrate losses generated by Sterling volatility? London is a truly global city and Clerkenwell is packed to the rafters with international furniture and interior companies. The effects of this market will be evident in the next 12 months – and not just in Clerkenwell…